Designated Free Zones in the UAE

Unlock 0% Tax Opportunities and VAT Optimisation

With Fintree’s Expert Guidance.

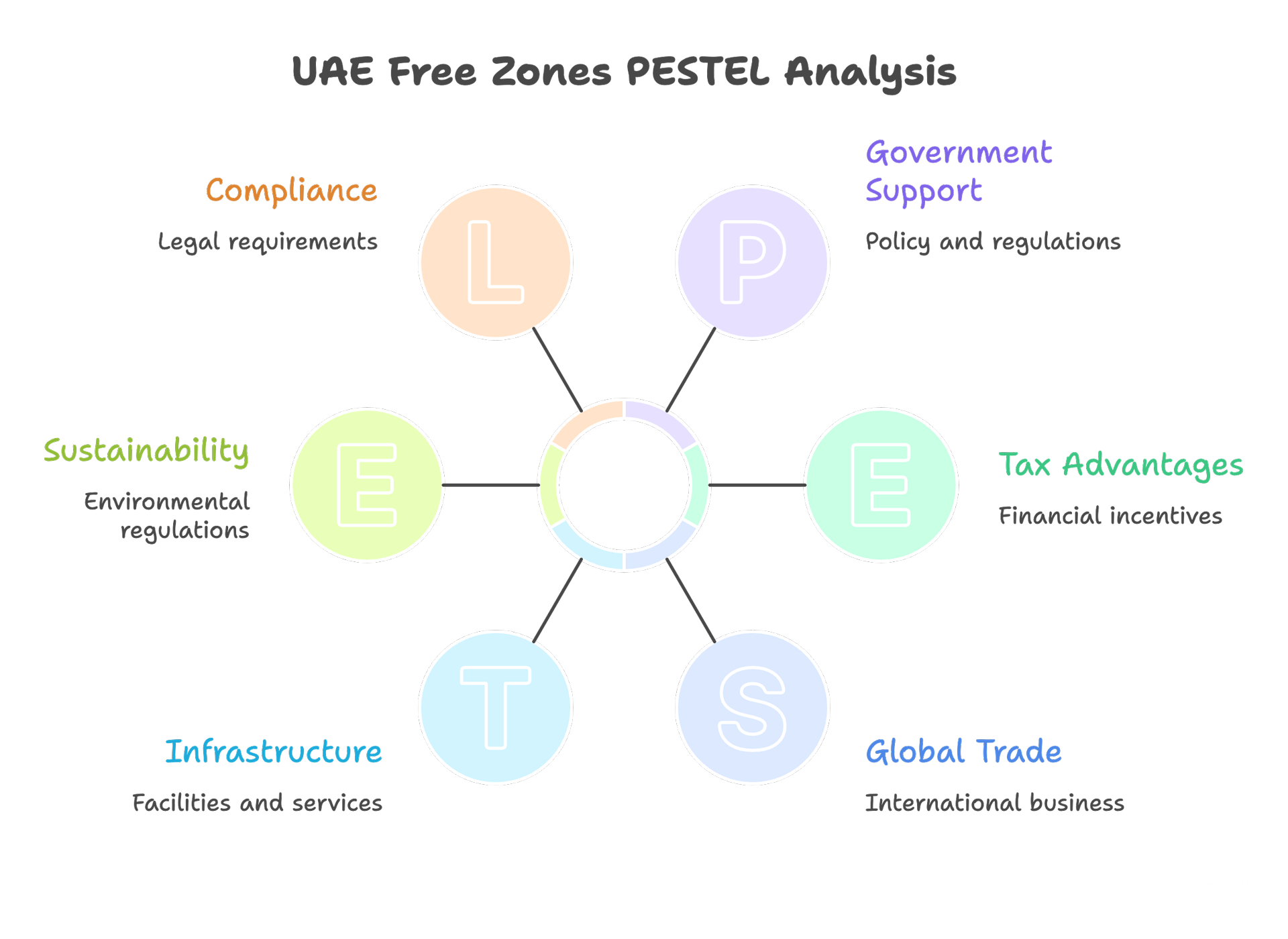

UAE free zones have long attracted entrepreneurs with promises of 100% foreign ownership and streamlined setup. Recent tax reforms have added layers of opportunity and complexity, especially around “designated free zones” that offer targeted VAT benefits and pathways to 0% Corporate Tax for qualifying activities.

VAT and Corporate Tax Benefits

Key Designated Free Zones

| Zone | Best For | Key Tax Edge | Infrastructure |

|---|---|---|---|

| JAFZA | Global trade, logistics | VAT zero-rating on re-exports; QFZP path | Port/airport access, 8,000+ companies |

| Fujairah FZ | Maritime, commodities | Goods storage exemptions | Deep-sea port, low setup costs |

| RAK Economic Zone | Manufacturing, industrial | Intra-zone VAT benefits | Warehouses, affordable land |

Comparison: Designated vs Other Structures

| Structure | Market Access | Ownership | Tax Snapshot | Ideal Business |

|---|---|---|---|---|

| Designated Free Zone | Zone-to-zone & exports strong; mainland limited | 100% foreign | VAT zero on qualifying goods; 0-9% CT potential | Traders, logistics, exporters |

| Regular Free Zone | Zone-focused; mainland via distributor | 100% foreign | Standard 5% VAT; CT per QFZP rules | Tech, consulting, services |

| Mainland | Full UAE (contracts, onshore sales) | Up to 100% in most sectors | Full VAT/CT exposure | Retail, services, gov tenders |

| Offshore | International holding/trading | 100% foreign | Often 0% CT; no UAE VAT | Asset protection, investors |